The latest fraud types and security tips to prevent them

Back to Cybersmart is the new business smartThe latest cybercrimes

AI scams

Artificial Intelligence (AI) is a technology that allows computers to mimic human-like thinking and decision-making. Fraudsters exploit such technology to make more convincing impersonations and create more sophisticated scams.

Business Email Compromise fraud

Fraudsters often impersonate business partners or managers to trick companies into amending their payment account details to credit them as the beneficiary.

Phishing

Fraudsters often send emails with malicious attachments or links to trick recipients into providing confidential information for accessing your accounts.

Vishing

Fraudsters posing as someone in a position of trust make phone calls to trick recipients into providing sensitive personal or financial information.

Malware

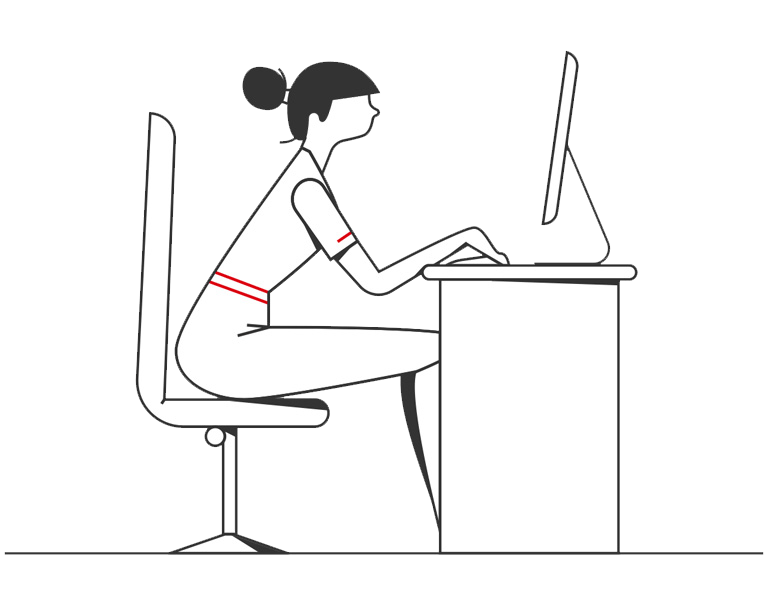

Malware consists of a wide variety of malicious code/software, designed to accomplish nefarious goals such as providing remote access, information theft, encrypting and hijacking access or device’s computing power.

Card fraud

Fraudsters often use card fraud to obtain assets unlawfully through unauthorised uses of credit or debit cards

The latest defrauding tricks shared by Hong Kong Police Force

1. Phone scammers impersonating bank staff

Phone scammers, posing as bank staff, falsely claimed that there were issues about the victim’s bank account and the account would be frozen, also claimed a need for identity verification to "unfreeze" the victim's bank account Their intent is to trick the victim into providing personal banking information and transferring funds to fraudulent accounts.

Security tips from Hong Kong Police Force

✅ DO

- Contact corresponding banks to verify the caller's identity

- Remind your relatives and friends to stay vigilant against similar scams

- Call the “Anti-Scam Helpline 18222” for enquiries

❌ DON’T

- Believe unknown callers who claim themselves as bank staff

- Disclose your confidential information to unverified bank staff

2. Phone scammers impersonating customer service staff

Phone scammers claiming themselves as customer service staff of a short video platform called victims requesting handling charges to cancel VIP member services. The scammers also claimed that their bank accounts would be frozen. The victims were instructed to transfer their savings to specific bank accounts and suffered pecuniary losses.

Security tips from Hong Kong Police Force

✅ DO

- Always verify the caller’s identity

- Enter the suspicious URL on “Scameter”, “Scameter+”, or the “Scameter” mobile application to assess the risk of fraud

- Remind your relatives and friends to stay vigilant against similar scams

- Call the “Anti-Scam Helpline 18222” for enquiries

❌ DON’T

- Download third-party software or make transfers

3. Investment fraud

Scammers claim to have insider investment tips on social media and ask victims to install an "investment platform" app. Their intent is to trick victims into transferring funds to fraudulent accounts.

Security tips from Hong Kong Police Force

✅ DO

- Ensure that the investment app you used is provided by trusted institution

- Pay attention to Anti-Deception Coordination Centre’s scam alerts

❌ DON’T

- Trust anyone who claim to possess insider investment tips

- Download any unknown investment app

Report Fraud

If you think you have been a victim of a scam or a fraud, click here to report it to us.

Find out more for being cybersmart

Protecting your account with HSBC’s free tools

Ways to use online and mobile banking more safely

How to handle and report fraud

Need help?

If you have question about our products and services, please click ‘Chat with us’.